Invoice factoring helps small businesses by converting invoices to immediate cash advances.

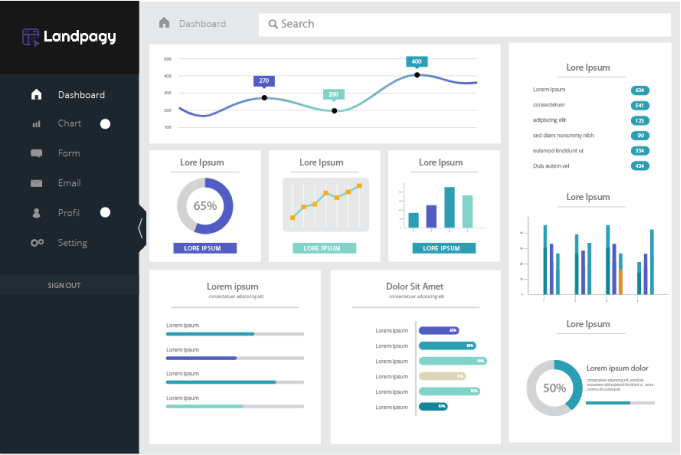

You’ll only need 2 important things to apply.

Start your business application and tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster (i.e. driver’s license or passport, business bank statements).

Our team will carefully review your business financing application. One of our trusted business advisors will reach out if we need any additional information.

If approved, our team will send your business’ funds to the business bank account provided. This can be as quick as a few minutes, so be on the lookout!

While most lenders and loan programs offered by the SBA have different eligibility requirements, the majority of these requirements are centered around the products or services the business provides, the character of its ownership, and the location of operation. Some of the main factors that the SBA requires are that the business is for-profit, located and operates in the USA, has invested equity in the business, and has had difficulty applying for financing with other lenders in the past.

This type of financing is ideal for businesses that do not receive payments for their products or services immediately but rather receive payment on their invoices in 30, 60, or 90-day terms.

The answer varies as there are many factors funders will take into consideration to approve a business other than just credit history. However, most funders are more focused on the outstanding invoices (and the payment history of those customers) versus the business’s credit history. The reason being is that the funder will collect the payments on the outstanding invoices once they purchase the invoices from the business. Not every funder works this way, so it may vary based on who purchases your invoices.

Ensure you’re selling invoices that have a history of timely customer payments. This will give you a higher chance of being approved.

Invoice factoring gives you quick access to working capital and improves cash flow. Plus, approval for invoice factoring is usually more flexible and easier to apply for. Businesses can take advantage of being able to improve cash flow by creating better relationships with their customers, as invoice factoring allows them to provide customers with longer payment terms.

Every funder has different requirements that must be met. As a general rule, most funders require that businesses sell to other businesses, have customers that have a history of making payments on time, are located and operate in the United States, and have invoices that pay on 30, 60, or 90-day terms.

Yes. Invoice factoring is a type of accounts receivable factoring.

At Money Lending Today, we’re dedicated to finding custom financing solutions for our small business clients. It’s simple, your business is our business. We provide you with all the resources you need to unlock big potential for your small business.

Have Questions?

You have a question and we have an answer. Speak to one of our business advisors today.

*Small Business Financial Solutions, LLC offers term loans and lines of credit (pursuant to its California Lenders License No. 603-I855) and factoring in California. Small Business Financial Solutions, LLC and Money Lending Today Services, LLC offer term loans, lines of credit and factoring outside of California. Commercial Servicing Company, LLC arranges term loans and lines of credit in California (pursuant to its California Finance Lenders License No. 603-J299) and arranges term loans, SBA loans, lines of credit, factoring, asset-based loans, commercial real estate loans and business credit cards outside of California.