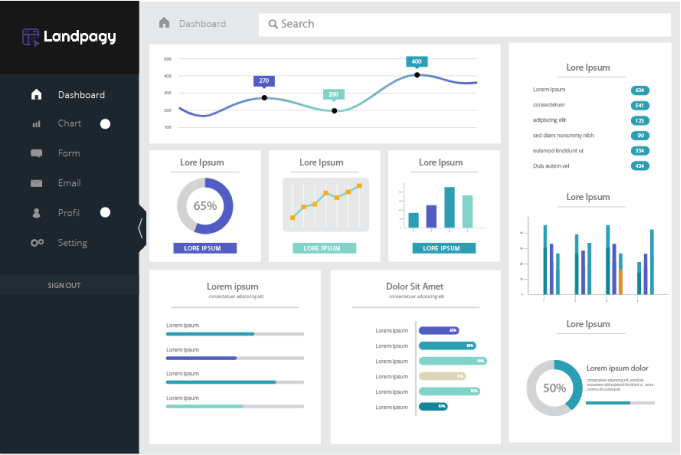

Our small business loans are simple and secure, so you can get the working capital your business needs fast.

You only need 3 important things to apply

Start your business application and tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster (i.e. driver’s license or passport, business bank statements).

Our team will carefully review your business financing application. One of our trusted business advisors will reach out if we need any additional information.

If approved, our team will send your business’ funds to the business bank account provided. This can be as quick as a few minutes, so be on the lookout!

Securing a small business loan doesn’t have to be hard. With Money Lending Today

, applying for a small business loan is simple and fast. Having the necessary documentation on hand will help ease the process. The most common documents needed are a valid form of identification, online access to your business bank account or three months of business bank statements, and your business bank account and routing number. Other information may be required in some cases. If approved, working capital will be sent directly to the business bank account provided.

Want more information? Check out our blog on how to get a small business loan for more in-depth answers.

Most alternative funders require the businesses to provide information regarding time in business, revenue, business bank account, and identification (i.e. driver’s license or passport). While this isn’t a comprehensive list, they’re the most common requirements when applying for working capital.

Credit is an important factor that both traditional lenders and alternative funders look at when trying to qualify a business. However, it’s not the only determining factor. Alternative funders like to look at the overall performance of a small business. This means looking at revenue, time in business, accounts receivables, and business credit history. For more information, reference our blog on how to get a small business loan with low credit.

A small business loan can be either short term or long term, it just depends on what the business needs. Rapid Finance offers loan terms starting at 3 months and can range up to 60 months*. Short-term loans are good if the business needs quick access to working capital and also wants to pay the loan off quicker. However, if a business is looking for longer repayment terms, it may qualify for a long-term business loan, provided the funder offers longer-term loans.

There are lots of factors to take into consideration when determining loan terms. The best thing to do is communicate your business needs with our team to find the best solution for your business.

Rapid Finance offers a small business financing calculator that will allow you to adjust certain business information accordingly, such as working capital amount, estimated credit score, and monthly sales. This allows you to see a broad estimate of what your small business may qualify for. To get a better sense of what you may qualify for, we recommend applying online through our website or giving us a call.

For an unsecured business loan, the lender doesn’t take an interest in the collateral and doesn’t file a UCC financing statement. In general, an unsecured loan increases possible risks for the lender. However, oftentimes an unsecured loan won’t offer as competitive of terms. Secured loans are typically a better option for many businesses as it helps reduce the cost of funds which can also help increase the amount of financing. It’s also important to consider that specific collateral (real estate, inventory, or other specific assets) can help increase financing even more.

At Rapid Finance, our secured loans are a great option for small business financing as the application process is quick and easy.

At Money Lending Today, we’re here to help you find the perfect small business loan for your business’ unique needs. Let us take financing off your plate so you can focus on what matters most: growing your business. Whether it’s location expansion, payroll, marketing efforts, new equipment, or technology, we provide all the financial resources your business needs to succeed.

Our financing options enable small businesses to access working capital when they need it most. We are 100% committed to the long-term growth of your business.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Money Lending Today

Have Questions?

You have a question and we have an answer. Speak to one of our business advisors today.

*Small Business Financial Solutions, LLC offers term loans and lines of credit (pursuant to its California Lenders License No. 603-I855) and factoring in California. Small Business Financial Solutions, LLC and Money Lending Today Services, LLC offer term loans, lines of credit and factoring outside of California. Commercial Servicing Company, LLC arranges term loans and lines of credit in California (pursuant to its California Finance Lenders License No. 603-J299) and arranges term loans, SBA loans, lines of credit, factoring, asset-based loans, commercial real estate loans and business credit cards outside of California.