Commercial real estate loans facilitate long-term growth by securing the property your business needs.*

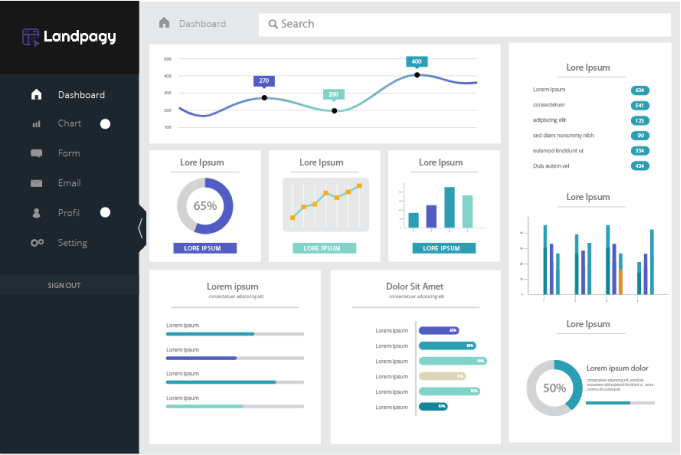

You only need 3 important documents to apply.

Start your business application and tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster (i.e. driver’s license or passport, business bank statements).

Our team will carefully review your business financing application. One of our trusted business advisors will reach out if we need any additional information.

If approved, our team will send your business’ funds to the business bank account provided. This can be as quick as a few minutes, so be on the lookout!

Commercial real estate loans work by granting businesses the working capital needed to purchase a new commercial property, refinance, or work on renovations for current commercial real estate. The loan is a mortgage secured by liens on the commercial property. Lenders will take into consideration the loan-to-value ratios, which means the process for getting approved varies greatly from a traditional residential mortgage.

A small business that wants to apply for a merchant cash advance must have accounts receivable such as credit/debit card sales and invoices. After they apply, the alternative funder will need to review credit card processing statements, business bank account statements, invoices, and other important documents.Any company that has the intention of purchasing a new commercial property, renovating a current commercial property, or refinancing a commercial mortgage should consider applying for a commercial real estate loan.

While many small business funding companies use personal or business credit as a factor when looking at your financing application, it’s not the only determining factor as to whether an application is approved or not. Most alternative smA commercial real estate loan makes sense for your company if you intend to use the working capital for commercial real estate. This type of loan will not work for primary or secondary residential residences. In addition, interest and repayment terms vary greatly from a residential mortgage.

Requirements vary depending on the lender and type of loan your business is looking to apply for. As a general rule, lenders will take into consideration your business financial statements, your company’s debt service coverage ratio, property characteristics such as property use and value, and percentage of expected/current occupancy.

Rates depend on the lender the business works with and the type of loan you’re looking to apply for to secure a mortgage. As mentioned, these rates are very different from a traditional residential mortgage loan, so please consider this before applying.

At Money Lending Today, we’re dedicated to unlocking big potential for your small business. Consider us part of your team, helping your business grow with flexible financing solutions tailored to your business’ unique needs.

Have Questions?

You have a question and we have an answer. Speak to one of our business advisors today.

*Small Business Financial Solutions, LLC offers term loans and lines of credit (pursuant to its California Lenders License No. 603-I855) and factoring in California. Small Business Financial Solutions, LLC and Money Lending Today Services, LLC offer term loans, lines of credit and factoring outside of California. Commercial Servicing Company, LLC arranges term loans and lines of credit in California (pursuant to its California Finance Lenders License No. 603-J299) and arranges term loans, SBA loans, lines of credit, factoring, asset-based loans, commercial real estate loans and business credit cards outside of California.