With lower interest and longer payment terms, SBA loans can be a smart way for small businesses to expand with help from the government.

Gather the following 5 documents to apply.

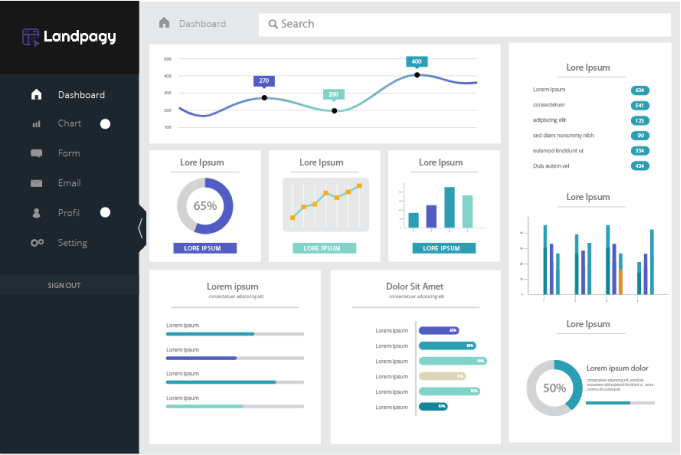

Start your business application and tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster (i.e. driver’s license or passport, business bank statements).

Our team will carefully review your business financing application. One of our trusted business advisors will reach out if we need any additional information.

If approved, our team will send your business’ funds to the business bank account provided. This can be as quick as a few minutes, so be on the lookout!

While most lenders and loan programs offered by the SBA have different eligibility requirements, the majority of these requirements are centered around the products or services the business provides, the character of its ownership, and the location of operation. Some of the main factors that the SBA requires are that the business is for-profit, located and operates in the USA, has invested equity in the business, and has had difficulty applying for financing with other lenders in the past.

The Small Business Administration works with various lenders. Any company seeking to apply for an SBA Loan needs to find a lender that works with the SBA, from there, fill out an application with that lender and provide all the documentation required. The lender will then review the application for approval.

To find your business’ SBA Loan status, it’s crucial to understand which type of loan program your business applied for. If you applied for an SBA loan, then the lender your business applied through would have this information, and you should contact them directly for status updates.

It’s a type of loan provided by the Small Business Administration that provides low-interest loans with long-term repayment options to businesses that have less than 500 employees, are non-profits, and sole proprietors or independent contractors that have been impacted by a major disaster. These types of disasters can be a result of a natural disaster or a healthcare pandemic, among others.

Each SBA lender requires different documentation and will ask qualifying questions during the application process. While each lender is different, it makes sense to have a business plan in mind, know the amount and use of funds needed, and have a good credit history. Financial projections, collateral, and industry experience are also a plus. The SBA states that even businesses with low credit still have a possibility of being accepted.

When filling out an application, documentation to have on hand includes past bank statements, a valid form of identification, a business checking account, and past tax returns.

Yes. SBA loans are ideal for businesses that are having a hard time getting approved by traditional lenders and require longer-term repayment options with lower interest rates.

At Money Lending Today, we’re dedicated to finding custom financing solutions for our small business clients. It’s simple, your business is our business. We provide you with all the resources you need to unlock big potential for your small business.

Have Questions?

You have a question and we have an answer. Speak to one of our business advisors today.

*Small Business Financial Solutions, LLC offers term loans and lines of credit (pursuant to its California Lenders License No. 603-I855) and factoring in California. Small Business Financial Solutions, LLC and Money Lending Today Services, LLC offer term loans, lines of credit and factoring outside of California. Commercial Servicing Company, LLC arranges term loans and lines of credit in California (pursuant to its California Finance Lenders License No. 603-J299) and arranges term loans, SBA loans, lines of credit, factoring, asset-based loans, commercial real estate loans and business credit cards outside of California.